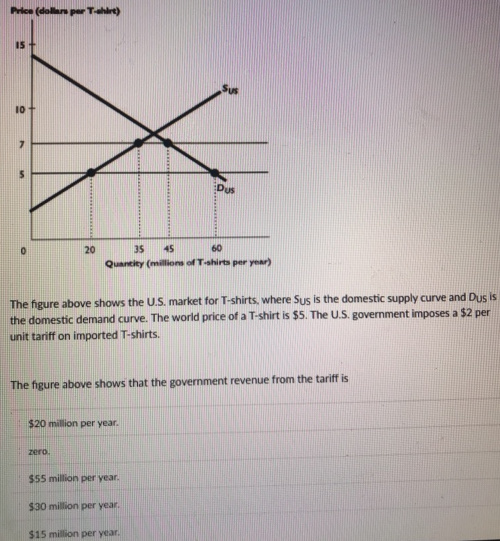

The figure above shows the U.S. market for T-shirts, where Sus is the domestic supply curve and Dus is the domestic demand curve. The world price of a T-shirt is $5. The U.S. government imposes a $2 per unit tariff on imported T-shirts The fgure above shows that the government revenue from the tariffis $20 million per year. zero $55 million per year $30 million per yean $15 million per year.

Answer:

Option (1).

With tariff, domestic price is $7 at which, quantity demanded is 45 million and quantity supplied is 35 million, so

Import (Million) = 45 - 35 = 10

Tariff revenue = Unit tariff x Imports = $2 x 10 million = $20 million