Explain the term trading on equity’. Why, when and how can it be used by a business organisation?

or

How does trading on equity’ affect the choice of capital structure of a company? Explain with the help of a suitable example.

or

How are the shareholders likely to gain with loan components in capital employed? Explain with suitable example.

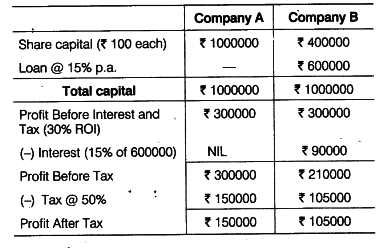

Trading on equity refers to the increase in profit earned by the equity shareholders due to the presence of fixed financial charges like interest. The use of more debt along with equity increases Earning Per Share (EPS). Let us take an example of companies A and B.

Earning Per Share (EPS) = Profit After Tax / Number of Equity Shares

150000 / 10000 105000 / 4000

= Rs 15 =Rs 26.25

Thus, from the above example, it is clear that shareholders of company B receive higher EPS than the shareholders of company A due to more debt in the total capital of company B.