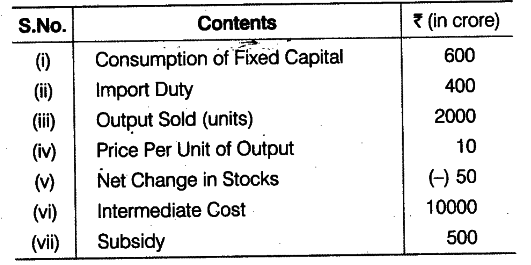

Calculate Net Value Added at Factor Cost.

Sales = Output Sold x Price Per Unit =2000 x10 = Rs 20000 crore .

Now, Value of Output = Sales + Change in Stocks = 20000 + (-50) = Rs 19950 crore.

$GV{{A}{MJ}}$ = Value of Output - Intermediate Cost = Rs (19950 - 10000) = Rs 9950 crore.

Hence, NVAFC = $GV{{A}{MP}}$ - Consumption of Fixed Capital - Net Indirect Tax (Import duty - Subsidy) = 9950 -600 - (400 - 500)

(Where Net Indirect Tax = Import duty - Subsidies) $NV{{A}_{FC}}$= Rs 19450 crore

Why consumption of fixed capital included