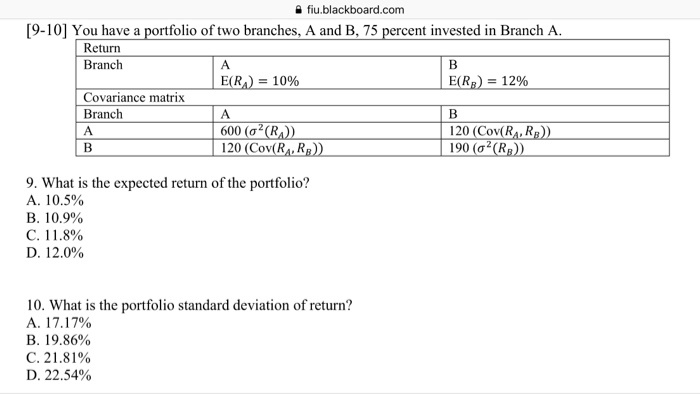

Answer:

Expected return on portfolio = XaE(Ra) + XbE(Rb)

where Xa is the percentage of the portfolio in A, and Xb is the the percentage of the portfolio in B

Xa = .75, Xb = .25

Expected return on portfolio = .75*.10 + .25*.12

= .105 or 10.5%(A)

Standard deviation of portfolio = (Variance of portfolio)^.5

Variance of portfolio = Xa^2(stnd deviation of Xa)^2 + Xb^2(stnd deviation of Xb)^2 + 2XaXbcovariance (Ra,Rb)

= (.75)^2*.06 + (.25)^2*.019 + 2(.75)(.25)*.0120

= .03375 + .0011875 +.0045

= .0394375

Standard deviation of portfolio = (.0394375)^.5

= .1986 or 19.86% (B)