Explain the concept of deficient demand in macroeconomics. Also explain the role of bank rate in correcting it.

A situation in an economy, when the Aggregate Demand is less than the Aggregate Supply, corresponding to full employment level, is termed as deficient demand.

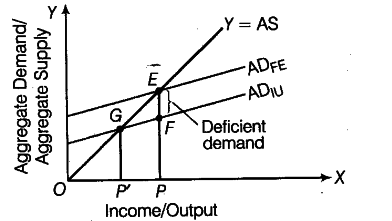

In the following figure, E is the equilibrium point of the economy where AD = AS. But at the current deficient demand of {{AD}_{IU}}, Aggregate Demand FP is less than the Aggregate Supply of, EP. Hence, EF represents the deficient demand in the economy.

Deficient demand gives rise to a deflationary gap and leads the economy to an equilibrium level of income/output that is less than the full employment level of income. This leads to deflationary pressures on economy and increases the inventory of producers. The producers are discouraged to produce more as price levels fall.

The economy therefore, will attain a new equilibrium at point G with National Income of OP’.

Where {{AD}_{FE}} = AD at full employment

{{AD}_{IU}} = AD at involuntary unemployment

EF = Deficient demand/deflationary gap

Role of Bank Rate in Correcting the Problem of Deficient Demand

The rate at which the Central Bank lends money to commercial banks is termed as bank rate. In case of deficient demand, the Central Bank reduces the bank rate to increase the money supply in the economy. Reduction in bank rate increases the credit/money creation capacity of commercial banks and also reduces the market rate of interest which encourages people to borrow more. In this way, the Aggregate Demand increases to the level of Aggregate Supply and the economy attains equilibrium.